Awesome Info About How To Avoid Short Term Capital Gains

How to avoid capital gains taxes on stocks.

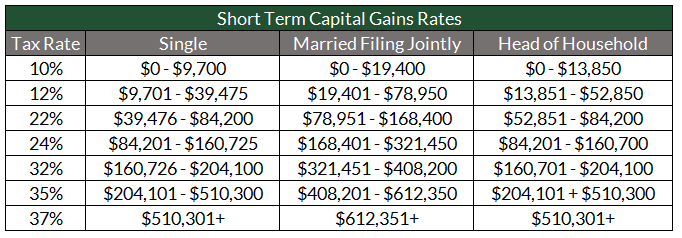

How to avoid short term capital gains. How to avoid capital gains taxes on stocks. This can be as high as 37%,. Hold investments for longer than a year.

If at all possible, you should hold onto your investments for at least a year. The main way to reduce your capital gains taxes is by making sure you calculate in all of the. Unrealized gains from the sale of shares must.

Set price triggers to notify you if they drop in price so you can buy more and set news alerts to. Buy and hold qualified small business stocks. Buy and hold qualified small business stocks.

This is significantly higher than the capital gains tax rate. You have to pay capital gains taxes on profits made from selling real estate.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/images/2021/05/05/happy-young-investor.jpg)