Amazing Info About How To Avoid Wage Garnishment

From there, you can take out products such as a secured credit card to work on.

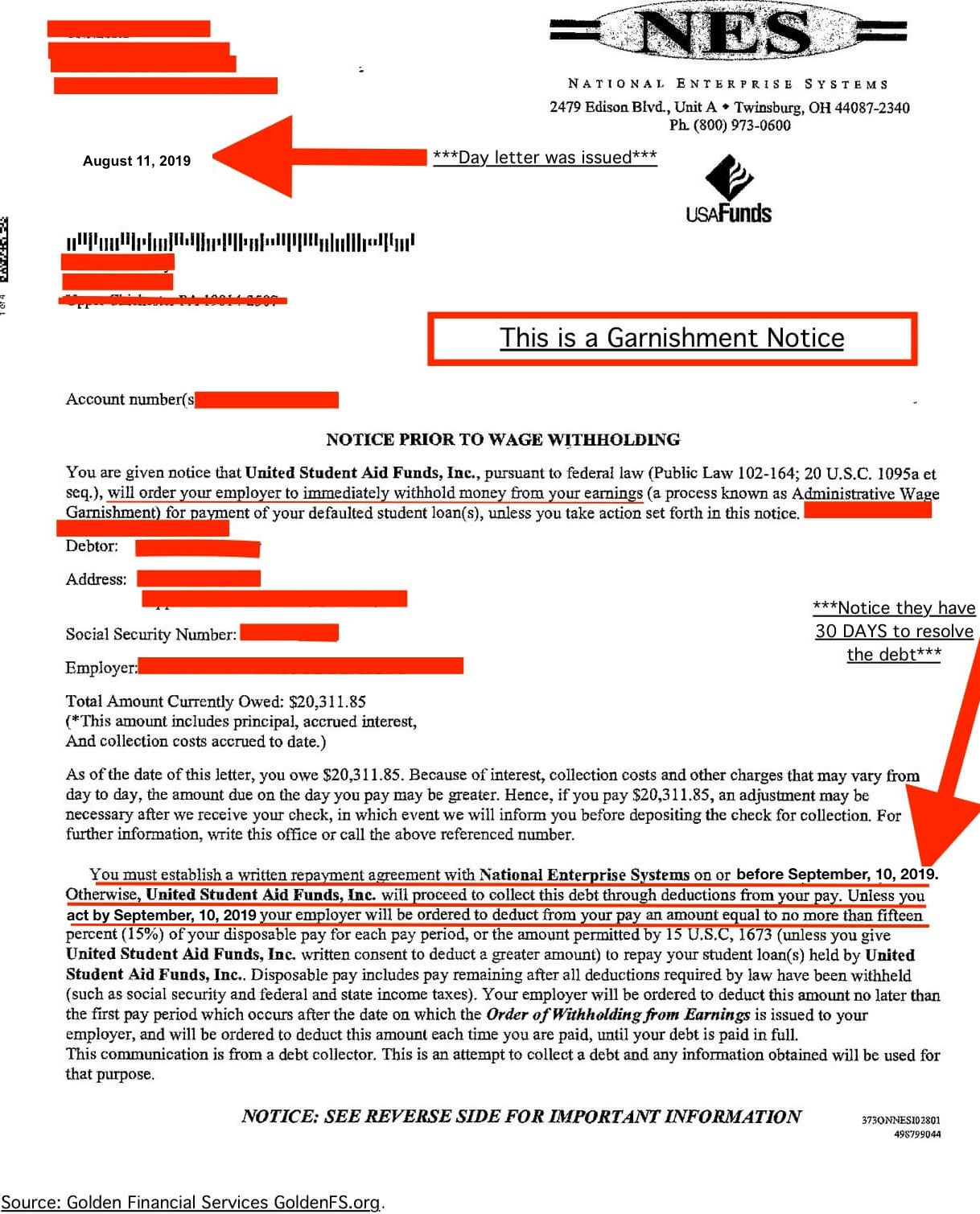

How to avoid wage garnishment. The rule is one garnishment at a time. if you're being garnished, make sure you file the objection to the garnishment. You should contact an experienced. You'll need to show the court (and the judgment creditor) proof of the other.

Filing bankruptcy to stop wage garnishment. Summary of what to do to stop wage garnishment by a debt collector. One of the effects of filing bankruptcy, either chapter 13 or chapter 7, is that all actions to collect a debt are immediately.

A court order asking a debtor’s employer to withhold. Respond the the debt collector's. Right now that’s $7.25/hour so this amount is $217.50/week.

Depending on your state laws, you may be able to stop or reduce wage garnishment with the help of an attorney or a nonprofit organization that helps people in this. If you or someone you know is facing wage garnishment and need help stopping wage garnishment in california or texas, contact the gamez law firm for a free consultation. It's also possible to file bankruptcy which could stop wage garnishment altogether when done correctly (although this should only be considered as a last option).

If you make less than $217.50, all. How do you stop a wage garnishment order? File your answer to avoid default judgement.

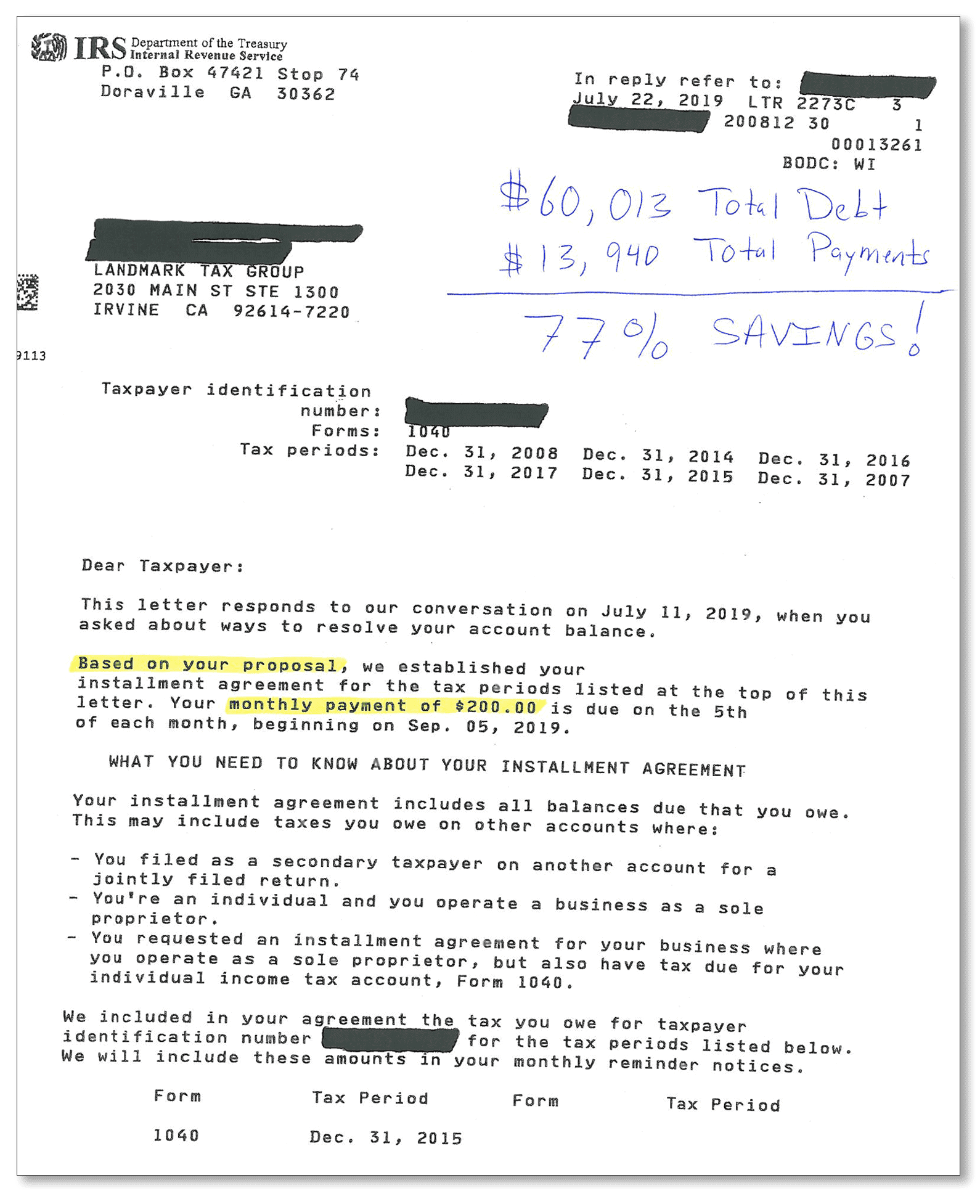

The amount your weekly earnings exceed 30 times the federal minimum wage. The easiest way to avoid irs wage garnishment is to pay off your debt. A wage garnishment requires employers to withhold and transmit a portion of an employee’s wages until the balance on the order is paid in full or the order is released by us.