Smart Info About How To Be Independent Contractor

Engaged in their own independently established business, occupation, trade, or.

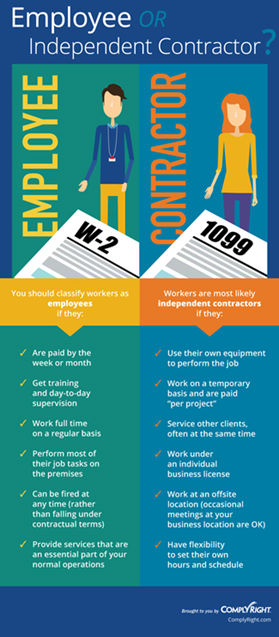

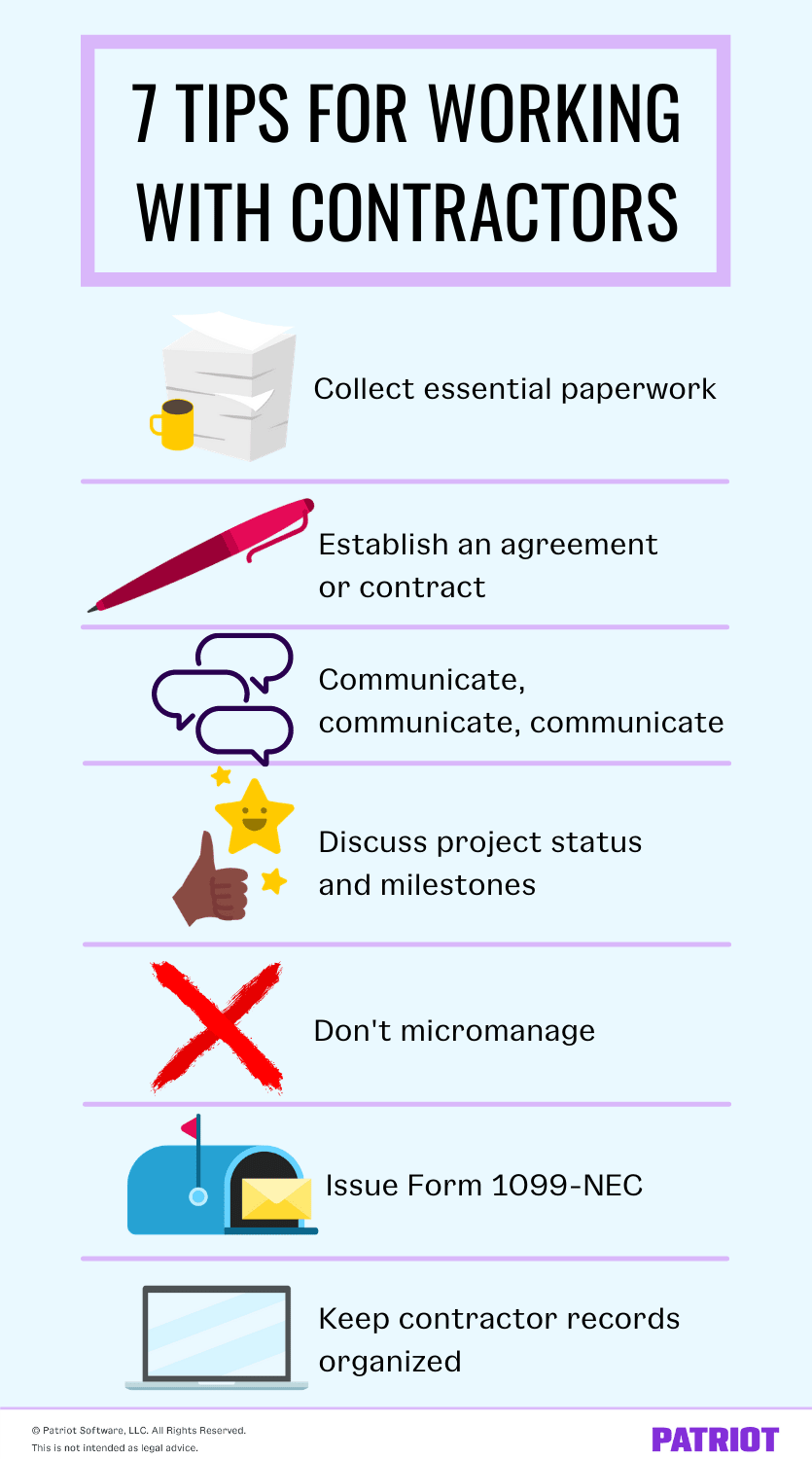

How to be independent contractor. Some states have restrictions on how a nurse can. Keep proper records for the prescribed time. Make sure you really qualify as an independent contractor.

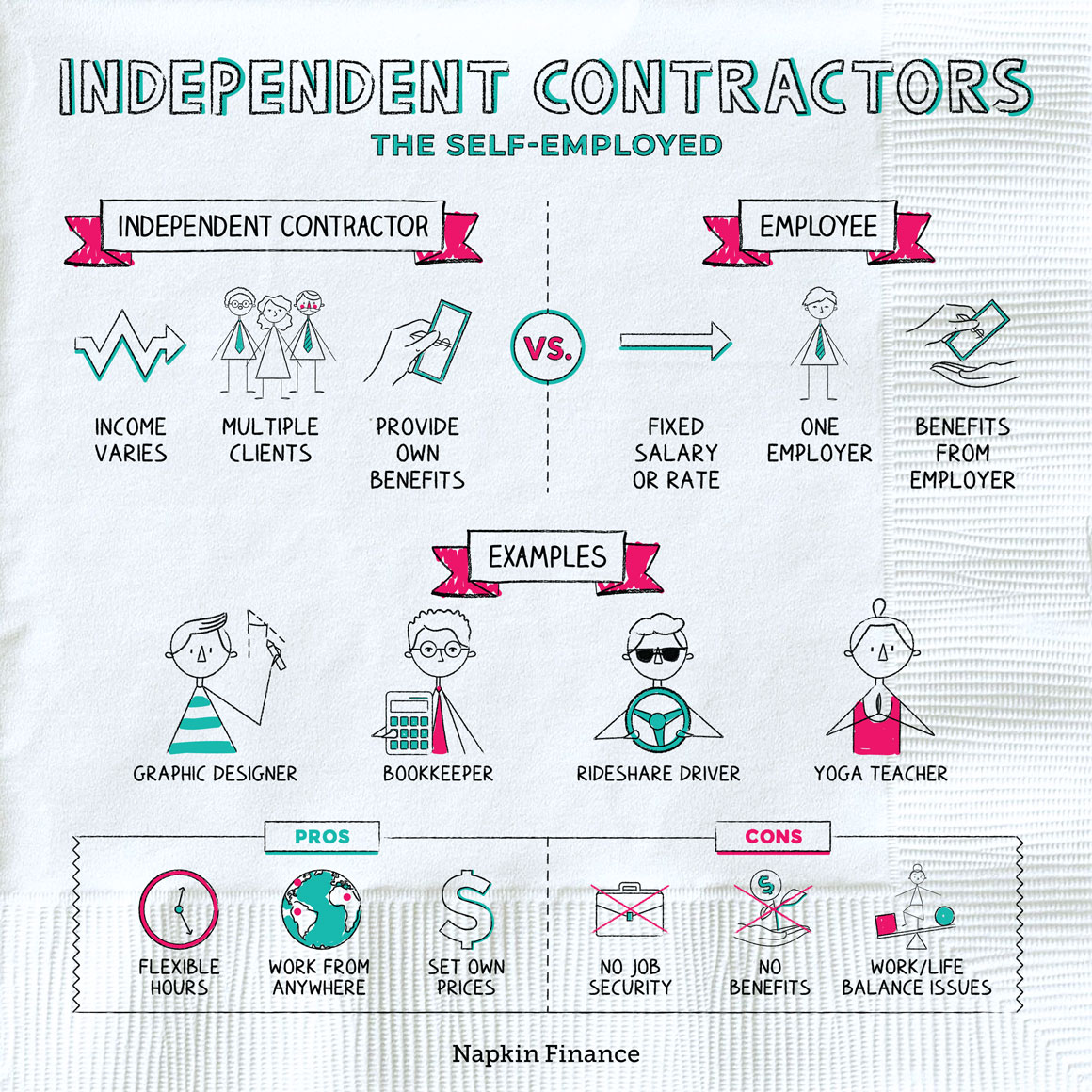

To perform your duties efficiently as an independent contractor, you need the following requirements: Most employers provide training for. As an independent contractor, you often set your own schedule and decide how many hours you will work.

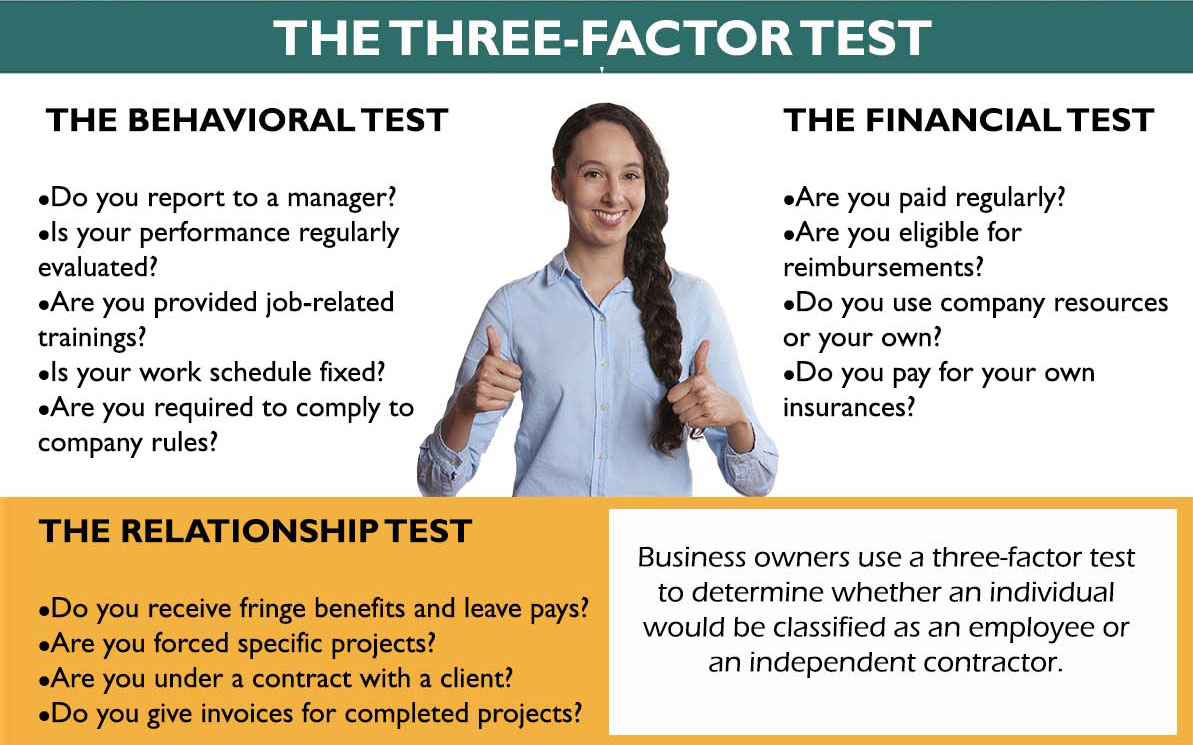

In determining whether the person. If you are looking to become an independent contractor, either to replace your “day job,” or just to make a little extra money on the side, here are some steps you need to take: The district court further stated that the independent contractor rule, independent contractor status under the fair labor standards act, 86 fr 1168 (jan.

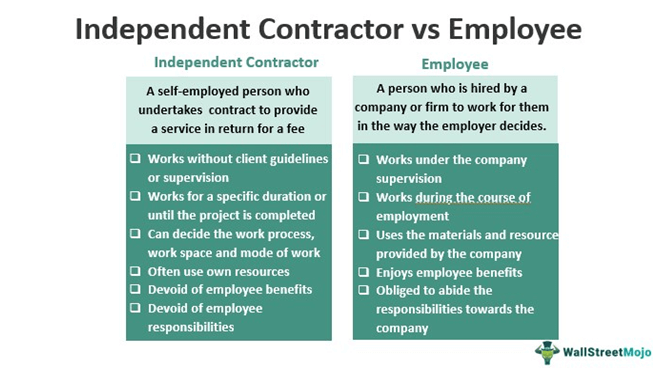

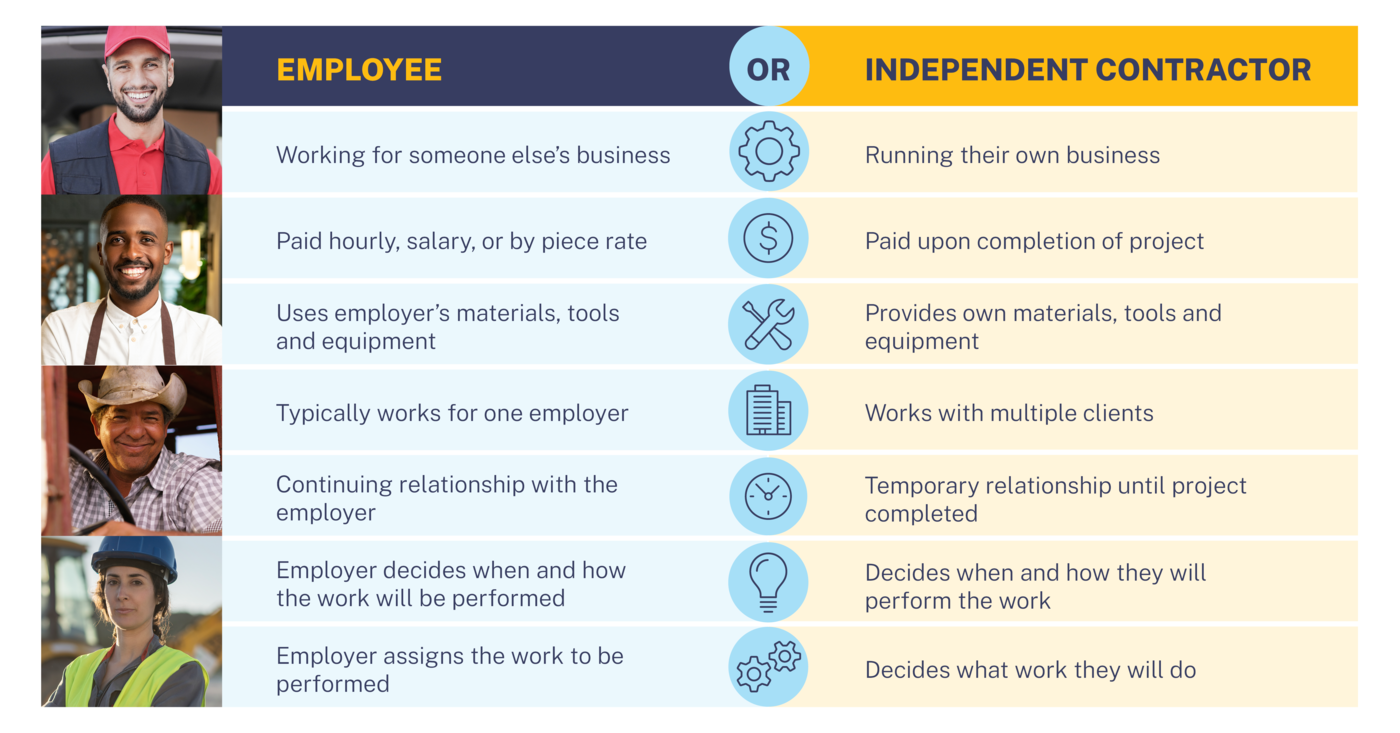

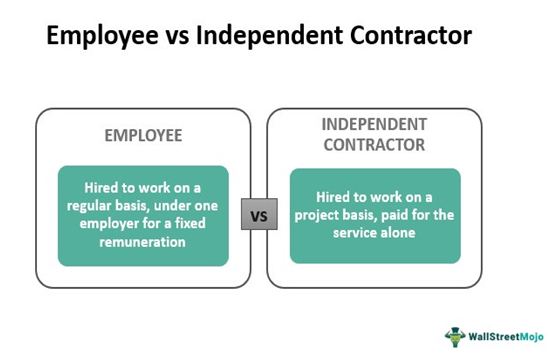

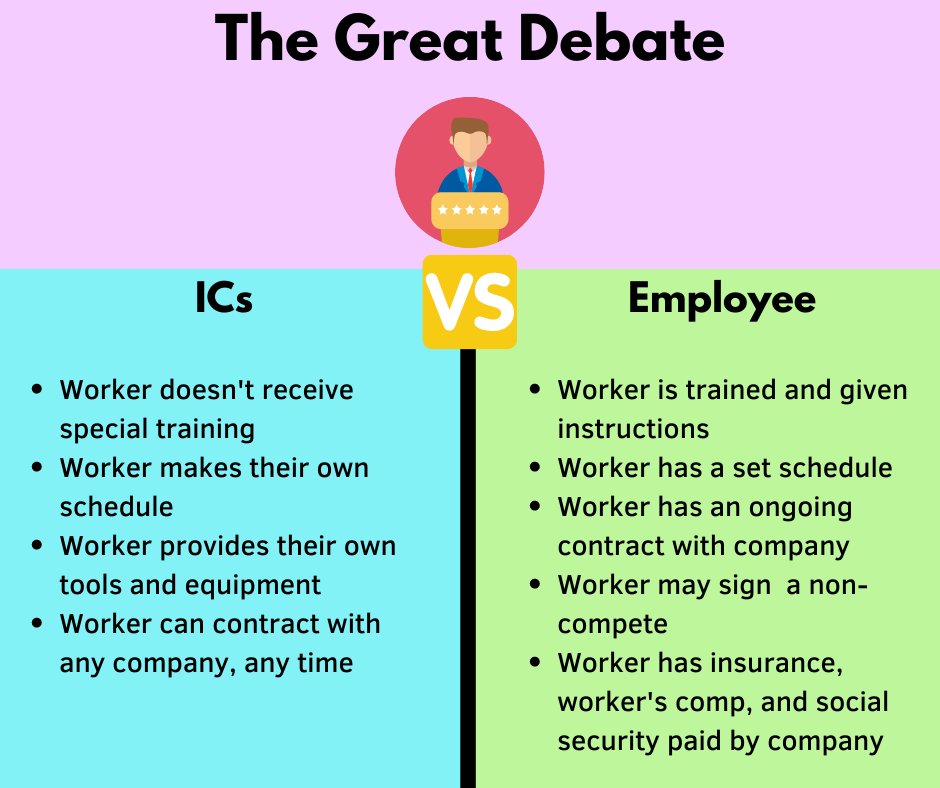

Becoming an independent contractor a worker must be: An independent contractor is a person who is in business on their own account. The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.

7, 2021), became effective as of. Free from control or direction from hiring agent. As an independent contractor, you may not have to make payments until you file your taxes, but these will be larger sums of money.

Start by calculating your taxable income after deductions. Control in the performance of their duties. An independent contractor is anyone who does work on a contract basis to complete a particular project or assignment.